Washington Becomes First State To Offer Public Health Insurance Option, Long-Term Care Benefit

READ ON

Washington is poised to become the first state in the nation to offer a public health insurance option, as well as a new, employee-paid long-term care benefit.

Gov. Jay Inslee, a Democrat who is running for president, signed both landmark measures into law Monday at a packed bill signing ceremony in the State Reception Room at the Capitol in Olympia.

“These two bills are models for the rest of the nation to consider,” Inslee said, according to prepared remarks provided by his office. “Washington state, once again, is at the head of the pack when it comes to policies that help working families and provide much-needed security when it comes to their health care.”

Last month, Colorado lawmakers approved legislation directing state agencies to develop a proposal for a public health coverage option. Other states are also consideration public option legislation.

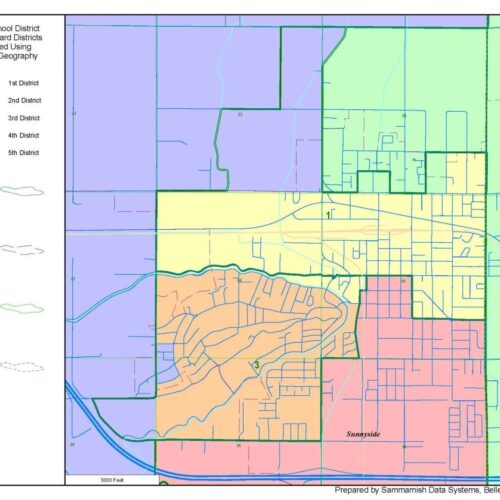

Under Washington’s new law, known as Cascade Care, the state will contract with private health insurance carriers to offer three levels of plans – bronze, silver and gold – beginning in November 2020. To keep premium and deductible costs down, the plans will cap total provider and facility reimbursement rates at 160% of Medicare.

The plans will be available on the state’s Health Benefit Exchange, the online insurance marketplace where individuals can sign up for Medicaid, if qualified, or purchase individual health insurance coverage. The exchange was created in 2011 to implement the federal Affordable Care Act in Washington.

Approximately 200,000 Washington residents, or less than 3% of the population, buy individual coverage on Washington’s Exchange. Between 2018 and 2019, enrollment in the individual market dropped by more than 13,000 people, according to data provided by the Exchange. The state’s most recent uninsured rate was estimated at 5.5%.

Participation by health insurers in Cascade Care will be voluntary. There’s also no guarantee that public option plans will be offered in all 39 Washington counties, though that’s the goal of the legislation. Health insurers can choose to bid to offer plans under Cascade Care in one or more counties, however there’s no requirement in the law that a health insurer offer statewide coverage.

The creation of the Cascade Care program, at the request of Inslee, follows years of volatility and double-digit premium increases in Washington’s individual health insurance market. This year, the state’s insurance commissioner approved an average premium increase of 13.5%. In 2017, the average rate increase was 36%.

Washington state officials said the individual insurance market has been buffeted by a series of Trump administration policies, including the end of federal reinsurance and cost sharing payments and the end of penalties for individuals who don’t buy coverage.

“It’s been a triple whammy that’s created this bow wave effect in terms of premium increases year over year,” said the Exchange’s CEO Pam MacEwan.

Currently, 14 of Washington’s counties only offer one individual health insurance plan option. In previous years, the state has scrambled to find even a single carrier to provide coverage in some rural counties and avoid what are known as “bare counties.”

Majority Democrats in the Washington Legislature embraced the public option as a way to increase offerings on the Exchange without reducing coverage mandates.

“This is going to lower premiums, it’s going to have better cost-sharing and Washingtonians will be much better off for it,” said the bill’s prime sponsor, Democratic state Sen. David Frockt of Seattle, on the floor of the state Senate last month.

Frockt said Monday he hoped the public option would be up to 10% cheaper than traditional plans on the Exchange.

But minority Republicans in the state Legislature opposed Cascade Care and warned of potential unintended consequences.

“We worry that this could distort the market,” said state Sen. Steve O’Ban, the ranking Republican on the Senate’s Health and Long Term Care Committee.

O’Ban said he was concerned individuals would jump from the small business insurance marketplace for Cascade Care. He also speculated that doctors might drop Medicaid patients “to make it work financially to participate in this plan with the lower reimbursement rates.”

In a statement Monday, Regence BlueShield of Washington said it is “still evaluating” the public option “to determine how Regence could be involved.”

Under Cascade Care, the state will not subsidize or help cover the cost of premiums beyond federal subsidies that are already available on the Exchange based on income levels. However, the new law requires the Exchange to study the feasibility of offering state-level subsidies in the future.

“We think initially the consumers that will be most interested in purchasing in these plans will be those who don’t qualify for subsidies and who are paying the full cost of healthcare out of their pocket,” MacEwan said.

Also this year, Washington Democrats passed legislation codifying in state law many of the Affordable Care Act protections. They also included in the new state budget a provision to create a work group on establishing a universal health care system in Washington.

Previously, Washington lawmakers considered creating a reinsurance program, similar to Alaska, to bring stability to the individual insurance marketplace. That proposal did not pass.

LONG-TERM CARE COVERAGE

Inslee on Monday also signed into law a bill creating what’s believed to be the nation’s first state-run, long-term care insurance program.

“Today is historic, for Washington state and for the entire country,” said Sterling Harders, the president of Service Employee International Union 775, which represents homecare workers in Washington state. “This legislation has been years in the making and is a huge step forward in changing the way we think about long-term care and caregiving.

Under the program, employees in Washington will pay a new .58% payroll tax beginning in 2020 – or about $6 per month for every $1,000 a person makes.

In 2025, the program will begin paying out benefits. To be eligible for coverage, Washington residents will have to work three years within the previous six years or a total of 10 years with at least five years of uninterrupted work. In addition, a person will have to work at least 500 hours in a year for that year to count towards eligibility. People who have purchased long-term care insurance could opt out of the program.

To qualify for the benefit, Washington’s Department of Social and Health Services (DSHS) will have to determine a person needs help with at least three daily living tasks. The maximum lifetime benefit will be $36,500 per person, tied to the consumer price index, and could be used to pay for things like adaptive equipment, in-home care or assisted living.

Supporters of the new long-term benefit say it’s needed because the majority of people 65 and older will need some form of long-term care, yet more than 90% of Washington seniors don’t have long-term care insurance, which is expensive and offered on a limited basis by private insurers.

Following national trend lines, sometimes called a “Silver Tsunami,” Washington’s senior population is expected to double to more than two million by 2040.

In a tearful speech on the House floor last month, Democratic state Rep. Laurie Jinkins, the prime sponsor of the bill, said the goal of the legislation was to make “sure that we no longer require people to spend themselves into poverty before they can get long-term care.”

“This is something that I feel like every member of this floor and this Legislature will be able to take great pride in for the rest of their lives,” Jinkins added.

Republicans countered that the program would prove too costly over time.

“We view this as an unsustainable tax on working Washingtonians,” said state Rep. Drew Stokesbary, the ranking Republican on the House Appropriations Committee, in a floor speech opposing the legislation.

Republicans also questioned whether the $36,500 benefit was sufficient. According to the state, the average cost for in-home Medicaid care is $24,000 a year and nursing home care is $65,000 a year.

“We’re entering into this system knowing full well that we haven’t actually set the tax rate at a rate sufficient to achieve permanent solvency of this system,” Stokesbary said.

According to Forbes, long-term care insurance proposals are also under consideration in Minnesota, Michigan and Illinois. The issue may also go on the ballot in California.

Copyright 2019 Northwest News Network

Related Stories:

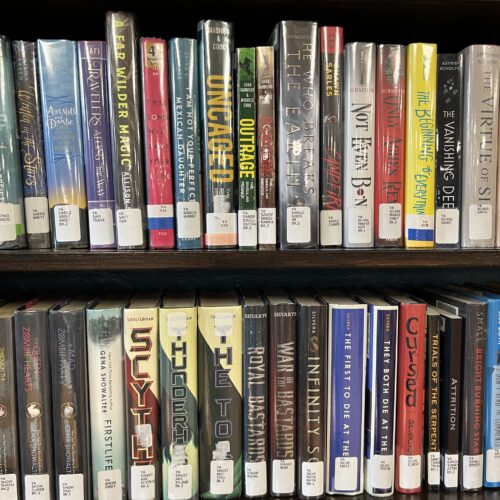

Washington state bill could change how rural communities could work to close a library

Young adult books at the Columbia County Library. Some people have requested to move the YA section into the adult section because of what they call “obscene” material in 100… Continue Reading Washington state bill could change how rural communities could work to close a library

Washington leaders try to find solutions for wolf depredations and killing of wolves

A gray wolf. (Credit: William Campbell) Listen (Runtime 1:07) Read Some ranchers are saying it is time to find creative ways to deal with wolf attacks on livestock. That’s what… Continue Reading Washington leaders try to find solutions for wolf depredations and killing of wolves

Washington bill aims to reduce ‘fast fashion’ carbon emissions, pollution

Pollution and greenhouse gas emissions from the manufacture of fast fashion are growing just as fast as the industry. A new bill in Washington aims to help lessen the industry’s… Continue Reading Washington bill aims to reduce ‘fast fashion’ carbon emissions, pollution