As election draws closer, Northwesterners weigh in on student loan forgiveness

Listen

(Runtime 3:57)

Read

At a café in downtown Pullman, Alura Lane is pulling shots for an Americano.

She is one of more than 43 million people in the U.S with student debt.

“I work here, basically, every single day of the week, and then I do my online classes after or before, but it’s not really my thing. I like going in person but I just can’t afford to do that anymore,” Lane said.

Lane is studying advertising at Washington State University. Right now, her debt is causing stress for her family.

“Six months after I graduate, I’m going to have to pay back $1,200 of student loans, like every month, which is very unrealistic, but it just honestly sucks because college is so unaffordable nowadays,” Lane said.

In the back of the café, Katie Van Wyngarden is sitting with her laptop and notebook.

She’s a financial planner with clients across the country.

“I would say probably a third of my clients have student loans that they’re navigating at some level, whether that’s kind of right out of college, as undergrads or as grad students, kind of later in their career,” Van Wyngarden said.

Her advice is to take advantage of any payment reduction or forgiveness plan that’s available and go for payments that are as low as possible.

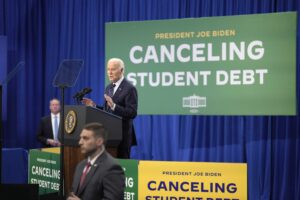

During a campaign stop in Wisconsin on Monday, President Biden announced new plans to cancel student debt.

President Joe Biden speaks at an event about canceling student debt, at the Madison Area Technical College Truax campus on Monday, April 8, 2024, in Madison, Wis. (Credit: AP Photo / Kayla Wolf)

“The ability for working and middle class folks to repay their student loans has become so burdensome that a lot can’t repay it for even decades after being in school,” Biden said.

At a coffee shop in North Idaho, Coeur d’Alene resident Major Aloysius said he believes President Biden is pushing student loan forgiveness as a way to pander for votes in November.

“Because most young people in college are going to be liberal, they’re gonna vote for a Democrat,” Aloysius said.

Lower income Americans who don’t have the opportunity to go to college will have to pay for loan forgiveness with their tax money, he said.

Aloysius originally wanted to go to school for engineering.

“There’s no way I was going to be able to afford college. I mean, I came from a dirt-poor family,” Aloysius said. “So why is the guy, the plumber, the guy who doesn’t have a degree, didn’t get to go to go to college, why’s he have to pay for those who did?”

While some say student loan forgiveness is going too far, others – including Braxton Brewington, said it hasn’t gone far enough.

Brewington works for Debt Collective, the nation’s first union of debtors.

He said Biden’s latest plan is actually weaker than the one proposed a few years ago.

“In some ways, we’re almost moving backwards,” Brewington said. “So, we’re talking about canceling interest, instead of principal, right? This is like cutting the top of weeds in your yard, but they’re just gonna grow back. We really need to pull this from the root in order for it to actually go away.”

People in favor of canceling student debt protest outside the Supreme Court, Friday, June 30, 2023, in Washington D.C. Baxton Brewington, press secretary for Debt Collective, said the organization is planning a day of action in Washington D.C. for May to push for student loan debt cancellation. (Credit: AP Photo / Mariam Zuhaib)

When he was a senator, Joe Biden was funded by credit card companies and big banks.

“Senator Biden was crucial in the push for making sure that bankruptcy protections were stripped from people who held student debt, and right now is the most progressive administration we’ve had on student debt, which is quite a low bar,” Brewington said.

So far, the Biden administration has approved $146 billion in student debt relief, which is about nine percent of the $1.6 trillion dollar debt held by borrowers nationwide.

Back in Pullman, Alura Lane said she studied abroad in Italy and Spain.

“I think if America took notes on other countries and their systems of education, it could be beneficial because other countries do have such a good and strategic way of educating their population without making their entire country go into hundreds of thousands of dollars of debt,” Lane said.

After the Supreme Court blocked his original student debt plan, the president is now pursuing a different route to forgive debt for people who have been paying for decades, and those experiencing hardship repaying their loans.

Details on the plans will be released in the coming months.

Produced with assistance from the Public Media Journalists Association Editor Corps funded by the Corporation for Public Broadcasting, a private corporation funded by the American people.