Governor Signs Washington Capital Gains Tax Into Law As Legal Challenges Loom

READ ON

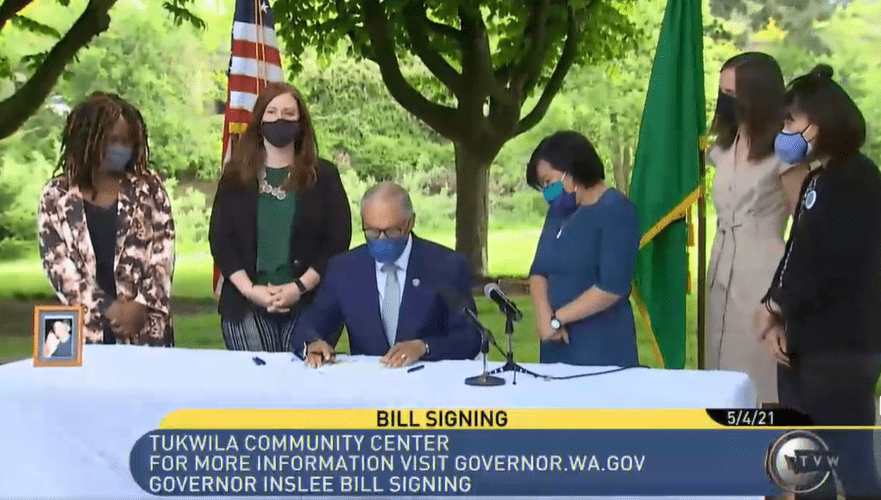

Washington Gov. Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the state’s wealthiest residents.

But the future of the tax is uncertain.

Already, the conservative Freedom Foundation has filed a lawsuit challenging the constitutionality of the tax. At least one other lawsuit is expected. The challenges could go all the way to the state Supreme Court.

However, the tax’s legal limbo didn’t dampen the bill signing ceremony which was held at the Tukwila Community Center and attended by the mayor of Tukwila, Democratic lawmakers and progressive advocates.

Inslee framed the enactment of the tax as a matter of fairness.

“It is a big stride to more justice by overturning the upside down tax system which has been so unfair to Washingtonians for so many decades,” said Inslee, a Democrat, who first proposed a capital gains tax in 2014.

At the same event, Inslee also signed a bill expanding the state’s Working Families Tax Exemption. Taken together, Inslee described the bills – one aimed at taxing the rich, the other at rebating taxes to struggling families — as an “economic justice legislative package.”

The capital gains tax imposes a 7 percent tax on profits over $250,000 in a year from the sale of such things as stocks and bonds. As estimated 7,000 tax filers would pay the tax in 2023, if it survives legal challenges.

The Working Families Tax Exemption, by contrast, is designed as a rebate on the sales tax that lower-income families pay over the course of a year. Under the expanded version, a married couple with three or more qualifying children that makes less than $56,844 in a year would qualify for an annual credit of up to $1,200.

The tax credit has been on the books for more than a decade, but lawmakers never funded it. That changed this year when Democrats and Republicans both threw their support behind finally making good on the promise of the rebate. It’s now funded in the 2021-23 biennial state budget.

While Democrats and Republicans came together around the tax credit, the capital gains tax fiercely divided the two parties.

Throughout the legislative session, Democrats insisted a tax on capital gains is an excise tax that will make Washington’s tax code less regressive. They often point to a report by the left-leaning Institute on Taxation and Economic Policy that found Washington has the “least equitable” tax system of any state.

“This is a step towards asking those who can pay a little more in taxes to do that for the sake of all Washingtonians,” said Democratic state Sen. June Robinson, the prime sponsor of the tax bill, during the final debate on the measure.

Republicans, in turn, lambasted it as unnecessary and unconstitutional. Specifically, they argued the capital gains tax is a form of a graduated income tax prohibited by a series of Supreme Court decisions dating to the 1930s.

They also said the Supreme Court might use the legal challenge to the capital gains tax to revisit those past decisions — a point one top Republican reiterated in a statement on Tuesday.

“If the governor was being forthright, he would have explained that this bill is a partisan effort to get the current state Supreme Court to reverse decades of precedent and clear the path for a full-blown income tax — a tax our state has never had, doesn’t need and doesn’t want,” said state Sen. Lynda Wilson, the ranking Republican on the Ways and Means Committee.

Additionally, Republicans criticized Democrats for including language in the capital gains tax bill that will prevent it from being potentially overturned by a voter referendum this fall. Democrats, in turn, defended that “necessary for the support of the state government” bill language by noting the first $500 million in revenues each year would go into the state’s Education Legacy Trust Account with the goal of expanding access to early learning and child care.

As written, the capital gains tax includes several exemptions for such things as real estate, retirement account assets, livestock and timberlands. A deduction is also granted for the sale of family-owned small businesses with $10 million or less in gross revenue in a year.

Democrats estimated that less than one-half of one percent of taxpayers would end up owing the tax. Republicans countered that future legislatures could easily lower the $250,000 deduction or raise the tax rate, or both. To bolster their argument, they noted that last December Inslee proposed a 9 percent capital gains tax on profits over $25,000 for individuals and $50,000 for couples.

Despite the pending legal challenges, the Washington Department of Revenue said Tuesday that it intends to move ahead with implementing the new tax.

“Delaying implementation would jeopardize the agency’s ability to effectively administer the tax within the timeline laid out in the bill,” the agency said in an email.

The tax is scheduled to take effect on January 1, 2022 with the first payments due the following April.

Related Stories:

WA Supreme Court upholds capital gains tax just weeks ahead of collection deadline

The Washington Supreme Court has ruled in a 7-2 decision to uphold the constitutionality of the state’s new capital gains tax. The decision filed Friday comes just weeks before taxes are due.

2nd Lawsuit Filed Seeking To Overturn Washington’s New Capital Gains Tax

The lawsuit by the Opportunity for All Coalition (OFAC), which successfully fought Seattle’s high-earners income tax in 2017, was filed Thursday in Douglas County Superior Court. The plaintiffs include business owners and farmers who would potentially be subject to the new tax, as well as the Washington Farm Bureau.

Lawsuit In Douglas County Seeks To Overturn Washington’s Newly Passed Capital Gains Tax

Just days after the Washington Legislature gave final approval to a new capital gains tax aimed at the state’s wealthiest residents, the conservative Freedom Foundation has filed a lawsuit on behalf of five individuals and one couple to overturn the tax.