Lawsuit In Douglas County Seeks To Overturn Washington’s Newly Passed Capital Gains Tax

READ ON

Just days after the Washington Legislature gave final approval to a new capital gains tax aimed at the state’s wealthiest residents, the conservative Freedom Foundation has filed a lawsuit on behalf of five individuals and one couple to overturn the tax.

In the complaint filed Wednesday in Douglas County, Washington, lawyers for the plaintiffs said the 7 percent tax on gains above $250,000 from the sale of such things as stocks and bonds is an unconstitutional income tax. They also said it violates the Commerce Clause of the U.S. Constitution.

“[R]egardless of your political orientaton or whether the tax personally impacts you, it is important to stand up to object when the constitution is violated,” said Callie Castillo, an attorney for the Lane Powell law firm in Seattle, in a statement.

The plaintiffs include Seattle business owner Suzie Burke, Chris Quinn of Cherry Hill Investments in Wenatchee and Maryhill Winery co-owner Craig Leuthold. According to the lawsuit, all of the plaintiffs own capital assets and would potentially be subject to the tax.

Supporters of the capital gains tax insist not an income tax, and say that by taxing the state’s wealthiest residents it will make Washington’s tax code less regressive.

In response to the lawsuit, House Majority Leader Pat Sullivan said in a statement: “They’re welcome to make their case. We assume this will make it to the state Supreme Court. It is the position of the Legislature that this is an excise tax.”

While legal challenges to the new tax were anticipated, the swift filing of the lawsuit by the Freedom Foundation came even before Gov. Jay Inslee has signed the tax into law.

Separately, the Opportunity for All Coalition (OFAC), which successfully challenged a high-earners income tax adopted by the city of Seattle in 2017, said Wednesday it too planned to file a lawsuit to overturn the capital gains tax.

“Washingtonians have rejected income tax measures 10 times before,” said OFAC President Collin Hathaway in a statement. “The state’s constitution clearly prohibits this type of tax, something that its supporters know.”

The Freedom Foundation and Lane Powell law firm also participated in the legal challenge to the Seattle income tax.

Related Stories:

WA Supreme Court upholds capital gains tax just weeks ahead of collection deadline

The Washington Supreme Court has ruled in a 7-2 decision to uphold the constitutionality of the state’s new capital gains tax. The decision filed Friday comes just weeks before taxes are due.

2nd Lawsuit Filed Seeking To Overturn Washington’s New Capital Gains Tax

The lawsuit by the Opportunity for All Coalition (OFAC), which successfully fought Seattle’s high-earners income tax in 2017, was filed Thursday in Douglas County Superior Court. The plaintiffs include business owners and farmers who would potentially be subject to the new tax, as well as the Washington Farm Bureau.

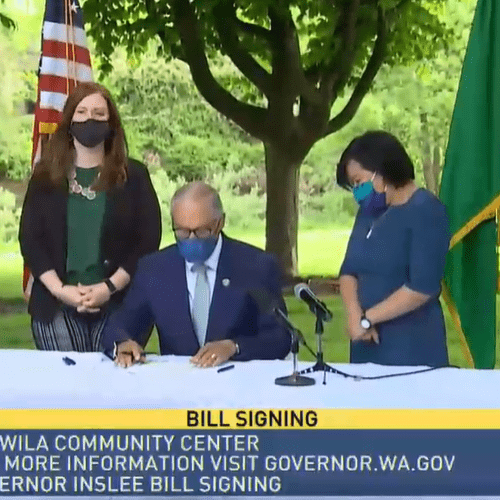

Governor Signs Washington Capital Gains Tax Into Law As Legal Challenges Loom

Washington Gov. Jay Inslee on Tuesday signed into law a new tax on capital gains aimed at the state’s wealthiest residents. But the future of the tax is uncertain.