Just days after the Washington Legislature gave final approval to a new capital gains tax aimed at the state's wealthiest residents, the conservative Freedom Foundation has filed a lawsuit on behalf of five individuals and one couple to overturn the tax. Read More

On Sunday, Democrats adjourned the session having accomplished much of what they set out to do, including passage of a number of sweeping bills that Gov. Jay Inslee, in a statement, called “historic” in nature.Read More

A new state capital gains tax. An expanded and fully funded tax credit for lower-income families. Fresh investments in disaster preparation and foundational public health. And significant new spending in early learning and child care. Those are among the elements of a proposed $59.2 billion, two-year budget Washington Senate Democrats unveiled on Thursday.Read More

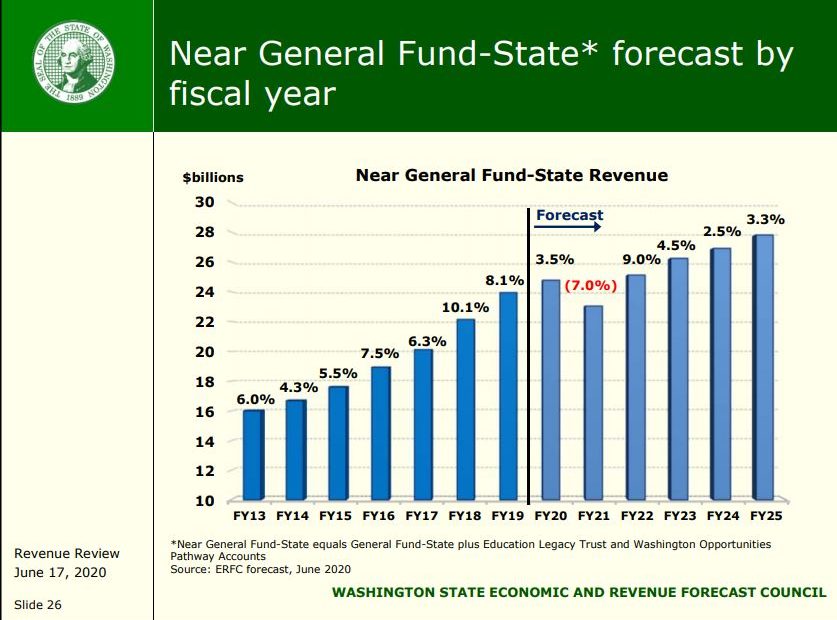

Washington’s improving fiscal picture isn’t an anomaly. A recent New York Times analysis shows that nearly half of states saw their revenues increase from April to December of last year. And many more experienced only slight declines. A key factor was federal aid that allowed even laid off workers to keep spending. Now, more federal money is headed to states from the Read More

Even as the state of Washington’s revenue picture improves, majority Democrats in the Legislature appear committed to a course that will, one way or another, involve raising taxes this year. Not necessarily to balance a recession-era budget, but instead to reform a tax code they view as regressive and to address gaps and inequities exposed by the global pandemic.Read More

As majority Democrats in the Washington Legislature lay the groundwork for tax increases to fund the next two-year budget, minority Republicans are jumping out ahead by releasing their own tax-averse budget blueprints.Read More

Amid the ongoing pandemic and threats by far-right protesters to "occupy" the Capitol, Washington lawmakers will convene Monday for what will ultimately be a mostly remote 2021 session with a focus on the ongoing response to COVID-19, police reform, addressing climate change and writing a two-year state budget.Read More

COVID-related aid and police reform will be two of the major issues before the Washington legislature when it convenes next month. But newly-reelected Lands Commissioner Hilary Franz hopes legislators will also consider dedicating more funding for wildfire and forest health projects.Read More

COVID-19 has hit at least 158 hospital workers since March, which takes them off the schedule and means a lot of overtime for the workers left on the wards. At least 64 patients have tested positive and one has died. Making matters worse, the economic downturn that resulted from the pandemic, and the loss of revenues needed to run state government s forcing the Department Read More

The tax measures are contained in the governor's two-year, $57.6 billion operating budget proposal released Thursday in advance of the 2021 Legislative session. Separately, the Democratic governor also released proposed capital construction and transportation budgets.Read More

The plan includes $26 million toward the establishment of a proposed new office to conduct investigations of police use of excessive force and $2.5 million for the state Equity Office that was created by the Legislature earlier this year. The equity office — created after voters last year reaffirmed a ban on affirmative action — will help state agencies develop and Read More

Washington state leaders say the earliest they would hold a emergency session at this point would most likely be after the November election, if they convene at all. It’s quite possible legislators won’t meet again until January, when their regular 105-day session is scheduled to begin.Read More

In a move not seen since the Great Recession, Washington Gov. Jay Inslee on Wednesday canceled pay raises for some state employees and ordered furloughs for many more through at least this fall. The move came the same day a new state revenue forecast projected an $8.8 billion drop in tax collections over the next three years.Read More

Washington Gov. Jay Inslee on Tuesday signed into law a $52.4 billion, two-year state budget that he said "rises to the needs of our time," but that minority Republicans quickly criticized as a "tax-and-spend home run." Read More

Tucked into Washington’s $52.4 billion operating budget passed Sunday night by the Legislature is controversial funding for a “stakeholder group” tasked with looking into what would happen should the four Lower Snake River dams be removed or altered.Read More

Washington lawmakers just wrapped up an action-packed, 105-day session with passage of the first state budget to exceed $50 billion and a bundle of tax hikes to fund it.Read More

Washington lawmakers adjourned at midnight Sunday after majority Democrats approved an initiative to restore affirmative action and passed a $52.4 billion, two-year state operating budget. The budget relies on an array of tax increases, including on businesses and real estate transactions, but doesn't impose a new capital gains tax as had been proposed. Read More

Washington Senate Democrats on Friday proposed a capital gains tax that would fund a suite of tax reductions for low-income families, small businesses and senior citizen homeowners. The tax proposal was rolled out in conjunction with the Senate Democrats' unveiling of a $52 billion two-year state spending plan, which followed a House Democratic budget presentation earlier Read More

Washington House Democrats have proposed nearly $1 billion in short-term property tax relief, followed by a longer-term tax cut funded by a new state capital gains tax on a minority of wealthier residents.Read More

Washington House Democrats on Tuesday proposed nearly $1 billion in short-term property tax relief, followed by a longer-term tax cut funded by a new state capital gains tax on a minority of wealthier residents.Read More

The Chehalis School District broke ground on one new elementary school, but a second has been put on hold after the Washington Legislature failed to pass a $4.1 billion capital […]Read More

The sewage system in Carbonado, Washington, is leaking. STEVEN PAVLOV / WIKIMEDIA – TINYURL.COM/YBZAMJ78 Listen The sewage system is crumbling in Carbonado, Washington, near Mt. Rainier. And if Washington lawmakers […]Read More

WSDOT / FLICKR Listen Time is running out for Washington lawmakers to pass a capital construction budget. Less than one week remains in the state’s third overtime session of the […]Read More

Washington Gov. Jay Inslee prepares to act on a business and occupation tax at the Washington capitol. AUSTIN JENKINS / NORTHWEST NEWS NETWORK Listen In a move certain to anger […]Read More

File photo. The Washington Supreme Court is likely to decide later this year whether the new budget adequately funds the state’s school system. AIDAN WAKELY-MULRONEY / FLICKR – TINYURL.COM/ZWJ3D3J Listen […]Read More

WSDOT / FLICKR Listen There’s still no word of a budget deal in the Washington state Capitol. And a partial government shutdown is just days away. Yet lawmakers remain optimistic. […]Read More

COLIN FOGARTY / NORTHWEST NEWS NETWORK Listen It’s do-or-die week in Olympia. If lawmakers don’t pass a budget and send it to the governor for his signature before midnight on Friday, […]Read More

The Washington Capitol in Olympia. WSDOT / FLICKR Listen After weeks of deadlock, Washington lawmakers could be close to reaching an agreement in principle on a state budget, House and […]Read More

File photo. A partial government shutdown in Washington state would mean state parks closing just in time for the Fourth of July holiday. WASHINGTON STATE PARKS – TINYURL.COM/Y8ZLZ8CA Listen If […]Read More

House budget chair Timm Ormsby, second from left, and Senate budget chair John Braun, on right, say they are working to get a budget deal by June 30th to avoid […]Read More

It looks like Washington Gov. Jay Inslee will have to call a third special session of the state legislature. The current overtime session ends Wednesday—and there’s still no budget deal.Read More

Washington voters will likely get to weigh in on police use of deadly force. A ballot measure on that subject turned in around 360,000 voter signatures Thursday afternoon. That should be more than enough to qualify for consideration by the Washington Legislature and then probably go to the statewide ballot in 2018.Read More

With a government shutdown looming, Washington Senate Republicans are characterizing the status of budget negotiations differently than Gov. Jay Inslee.Read More

There are just 10 days left in Washington’s second legislative overtime session. And still there’s no sign of a budget deal.Read More

Washington Gov. Jay Inslee is sounding the alarm over the pace of budget negotiations at the state Capitol. During a media availability Monday, the Democrat said that it’s time for both sides to make “major moves” toward compromise.Read More

The halfway mark has come and gone in Washington’s 30-day special session of the legislature. But there’s still no deal on a budget or a school funding solution.Read More

Time is running out for Washington lawmakers to negotiate a state budget that complies with a Supreme Court ruling to fully fund schools.Read More

Washington Senate Republicans are looking for ways to save money on state subsidized child care for low-income families. And they think they’ve found a way.Read More

Washington Senate Republicans have proposed a $5 billion increase in state spending over the next two years, including $1.8 billion more for public schools in an attempt to satisfy a Supreme Court ruling that found the state is not adequately funding K-12 education.Read More